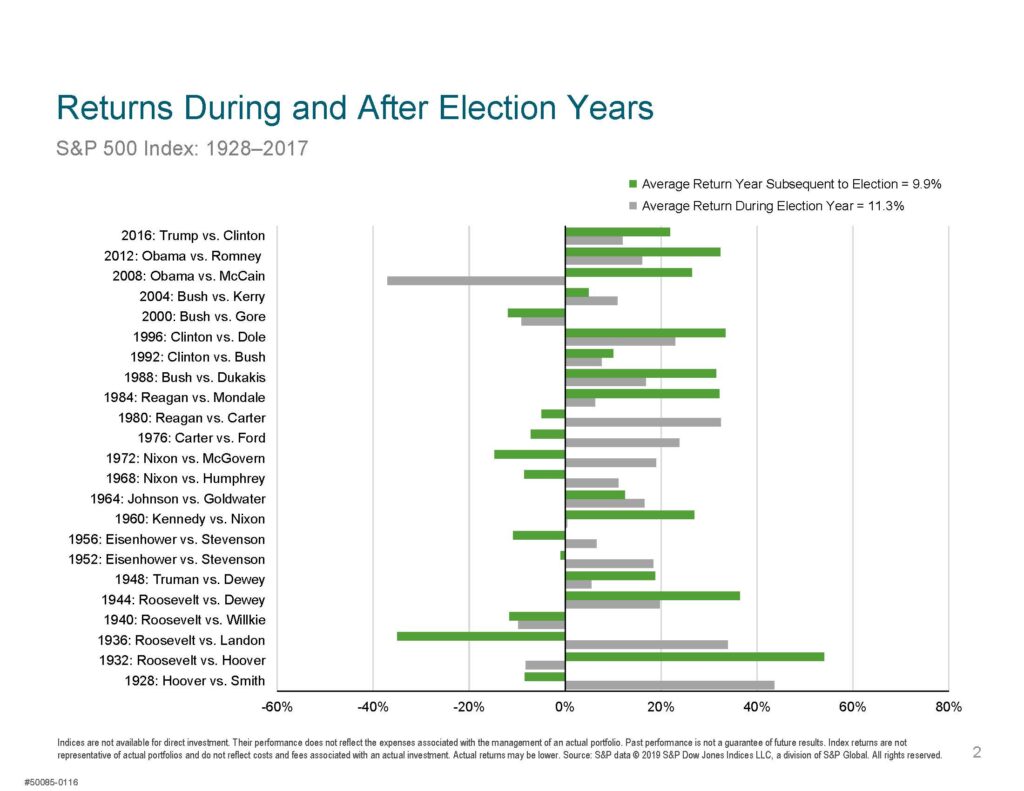

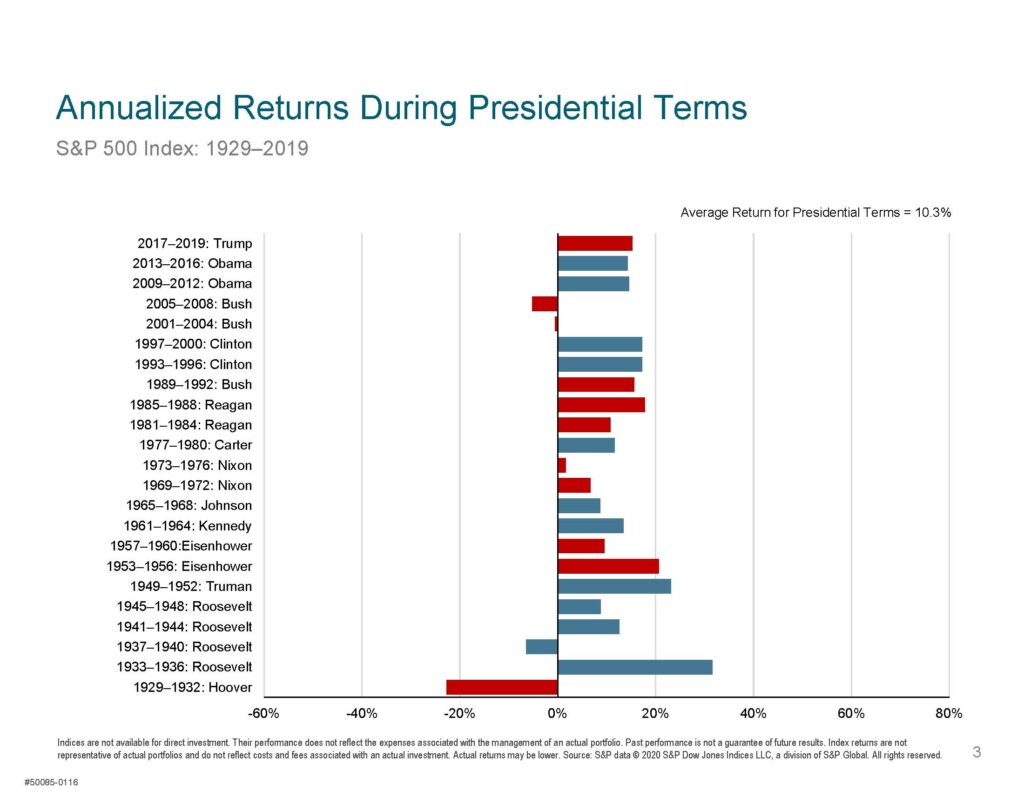

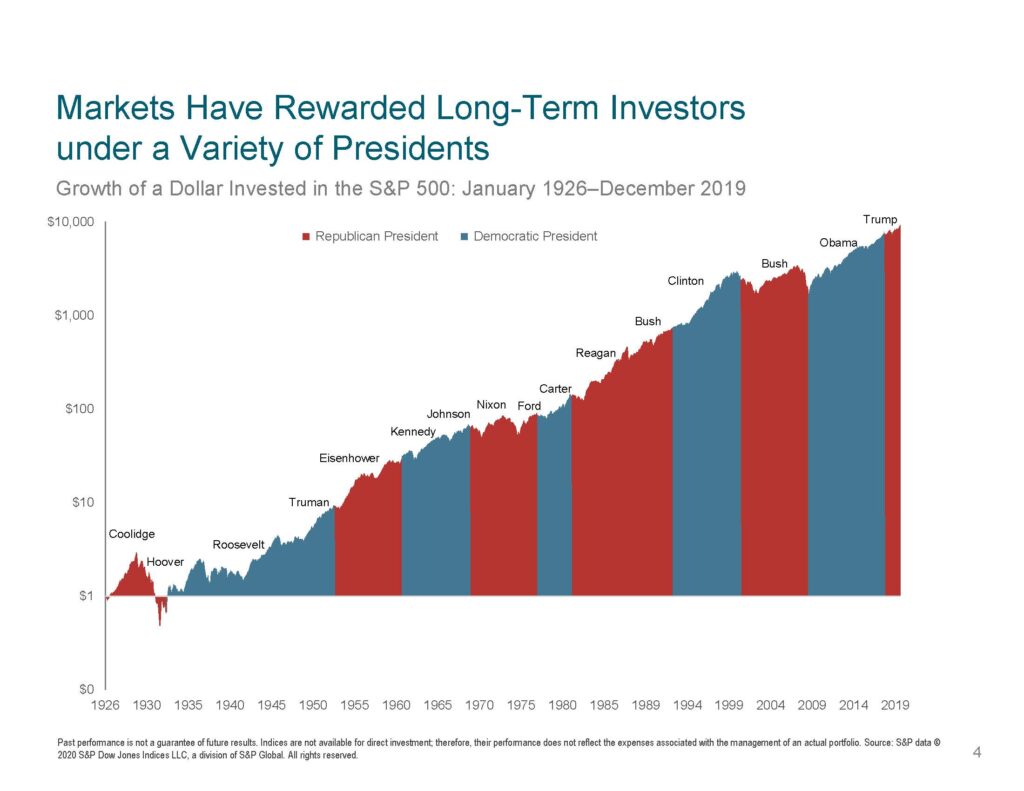

Summer is behind us and many are preparing for additional months of in-home education as schools remain predominantly closed. While Labor Day likely felt different than in past years, our ability as a nation to adapt to any situation remains unwavering. As the shift from constant conversations around COVID-19 and cleaning protocols wanes, all eyes appear to now be focused on our next big challenge as a nation. The U.S. Presidential Election is two months away and, as a result, many investors are wondering how the financial markets will be impacted? Market data collected over nearly 100 years show that, on average, market returns have been positive in both election years and the subsequent year, regardless of the elected party.1

As the slides below reflect, no single election outcome has derailed our long-term positive momentum as a country. Markets are consistently forward looking with current prices reflecting predicted election outcomes as well as expected earnings of individual companies. The markets are already looking past November. The prices and expectations consistently change as new information becomes available, so we do expect continued volatility. However, companies and individuals have proved adaptable and resilient over time to any economic or tax policy changes that may come after a contest is decided.

Keep in mind that a contentious election could raise already heightened stress levels and will likely not reflect the hope on which our nation was founded. As Louis Brandeis, an American lawyer and associate Justice to the US Supreme Court (1916-1939) said, “The most important office, and the one which all of us can and should fill, is that of a private citizen.” So while we cannot control the rhetoric or outcome of the election once our ballot is cast, COVID-19 has reminded us all of the power of kindness and futility of fear.

1 Source: Vanguard calculations based on data from Global Financial Data through 12/31/2018.