As the U.S. stock market reaches new highs, you may be asking yourself, “Why aren’t my accounts doing the same?” The answer can be complicated, but for most investment portfolios the answer comes down to one word, diversification. In simple terms, diversification is the strategy of investing in many different asset classes and securities in an attempt to lower overall risk. The old phrase “don’t put all your eggs in one basket” echoes this strategy.

Diversification starts by having a combination of stocks and bonds in a portfolio. The stocks help provide long-term growth to lessen the impact of inflation, while the bonds provide income and stability at times when stocks are volatile.

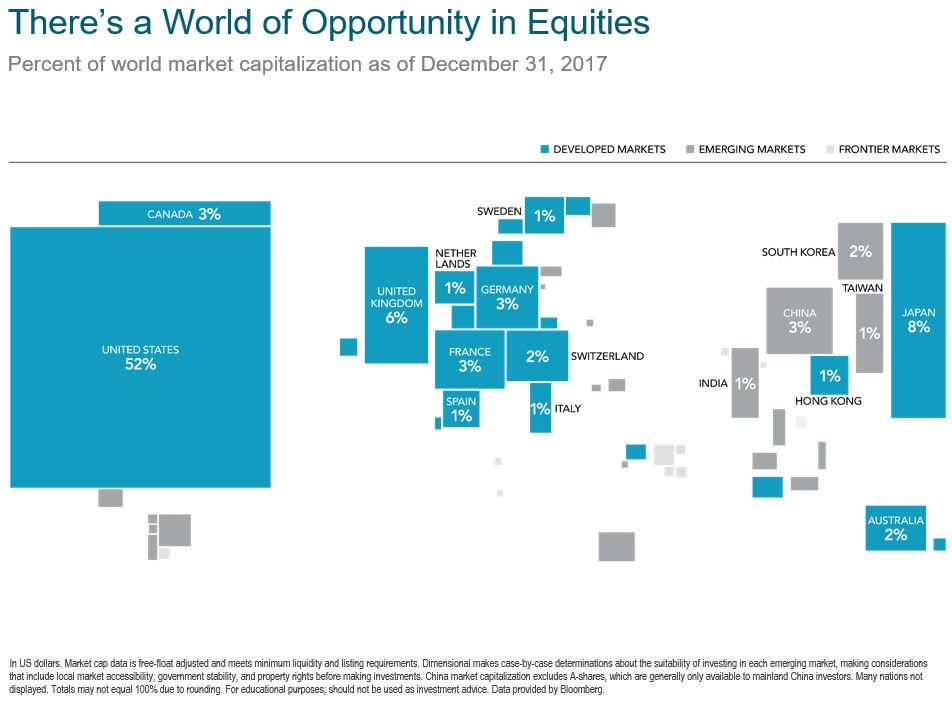

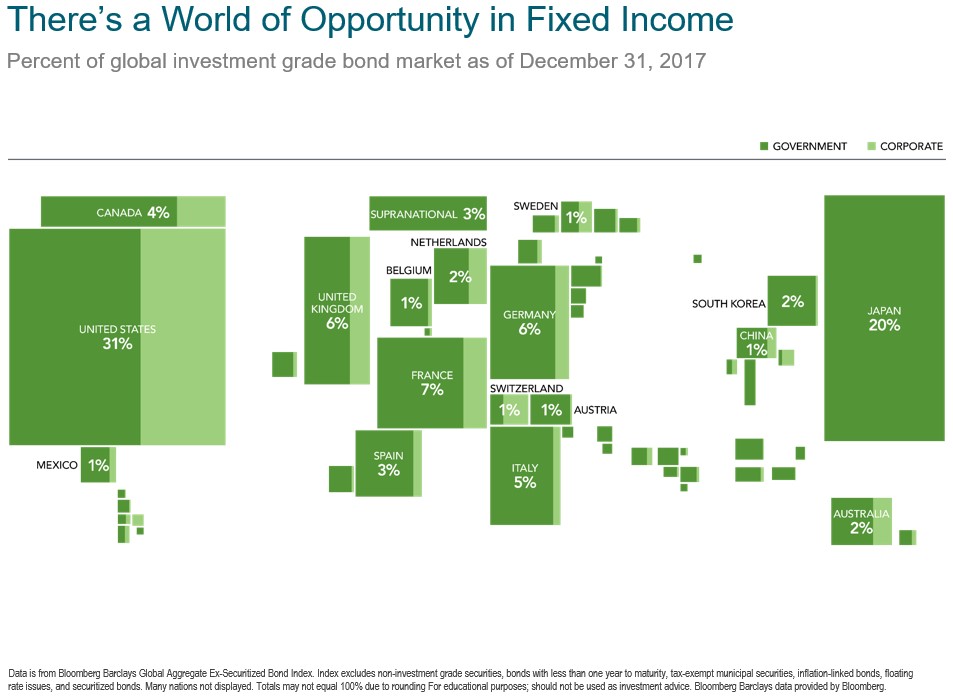

Verus takes additional steps to diversify by adding non-U.S. stocks and bonds. While it’s easy to focus solely on the U.S. markets, it is important to realize that about half of the total value of all stocks and bonds are now located outside of the United States, as shown in Exhibits 1 and 2. Using this global approach to investing helps capture the full benefits of diversification.

Exhibit 1.

Exhibit 2.

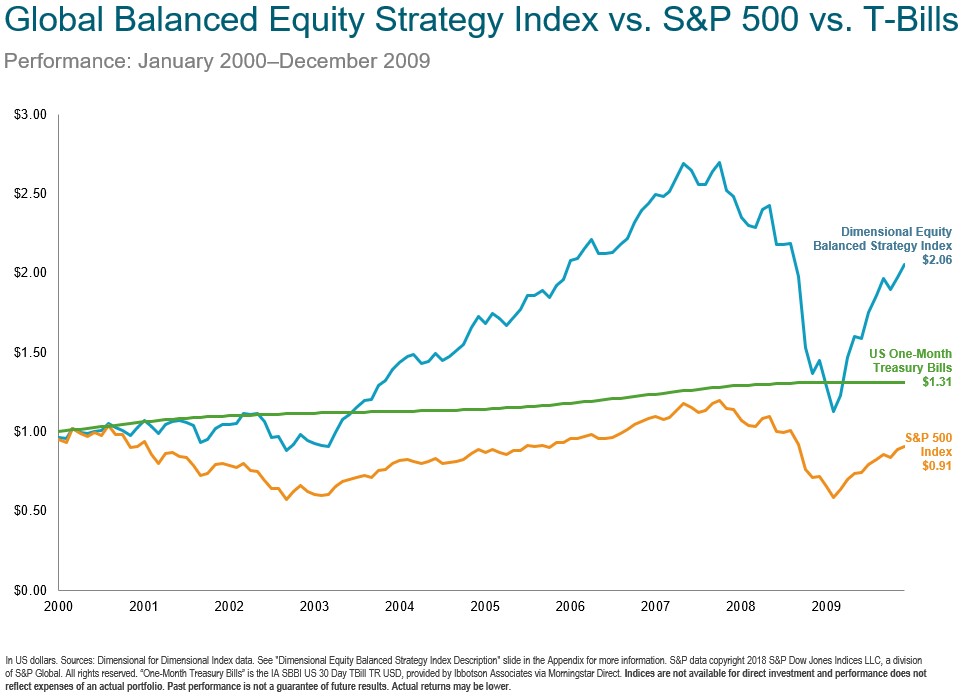

It is important to remember that markets can change quickly and a globally diversified portfolio has been shown to add protection, while also rewarding investors over the long term. There have been years where U.S. stocks have performed poorly, while international stocks have performed well and vice versa. For example, the following chart shows the “lost decade” in U.S. stocks compared to bonds and a diversified stock portfolio.

Exhibit 3.

(Click here if the charts are not displaying properly on your device.)

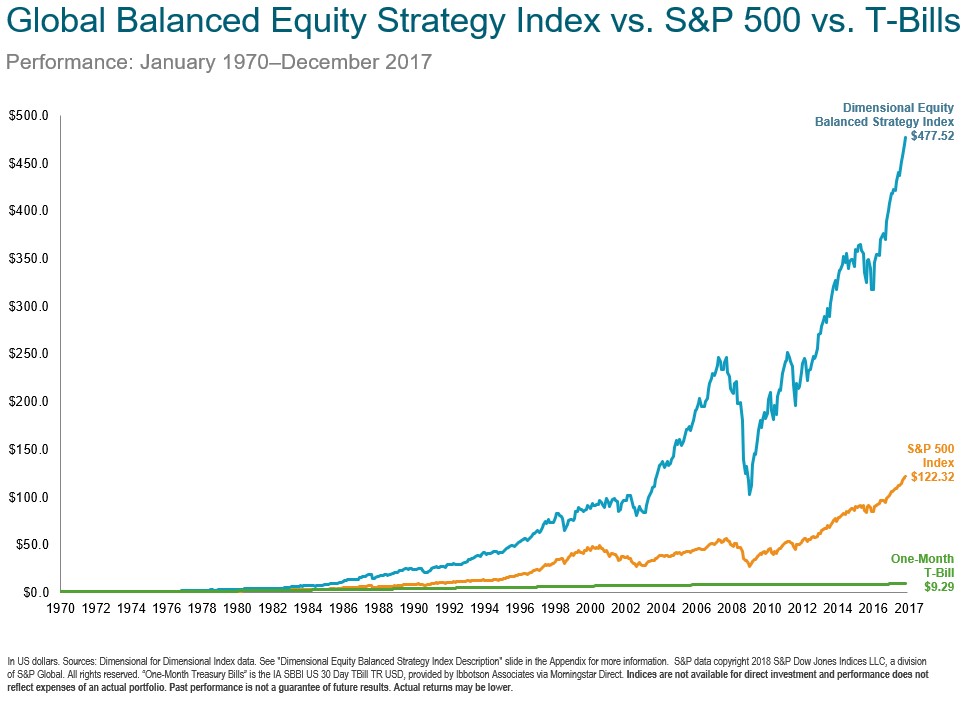

Looking out over longer time periods, a globally diversified stock portfolio has continued to outperform the S&P 500, as shown in Exhibit 4 below.

Exhibit 4.

The same is true for bonds. Bonds typically do not have the high returns that stocks produce, but they still serve a valuable purpose in a portfolio. As stated above, bonds help add stability during times of stock market volatility and help smooth out the shocks that can often happen in the stock market. In addition, they provide income to your portfolio. At Verus, we focus on high quality investment grade bonds both in the U.S. and internationally. If we determine that more risk is required in a portfolio, we increase your allocation to stocks, not to speculative or high-risk bonds.

Therefore, the next time you look at your statement, remember that each investment serves a purpose for diversification. Some assets will be up and some will be down, but working together in a globally diversified portfolio, we believe they will provide the returns and balance needed to accomplish your financial goals.

Appendix:

Dimensional Equity Balanced Strategy Index Description

Rebalanced monthly. The Dimensional Equity Balanced Strategy Index is comprised of commercial and Dimensional indices, 70% US equity indices, and 30% non-US indices. US: S&P 500, large cap value, small cap, small cap value, Dow Jones REIT; non-US: international value, international small cap and small cap value, emerging markets, and emerging markets value and small cap. See “Descriptions of Dimensional Indices”.

Real Estate Strategy weighting allocated evenly between US Small Cap and US Small Cap Value prior to January 1978 data inception.

International Value weighting allocated to Fama/French International Value Index prior to January 1994 data inception, and evenly between International Small Cap and MSCI EAFE Index (net dividends) prior to January 1975 data inception. International Small Cap Value weighting allocated to International Small Cap prior to July 1981 data inception.

Emerging Markets weighting allocated to MSCI Emerging Markets Index (gross dividends) prior to January 1994 data inception, and evenly between International Small Cap and International Value prior to January 1988 data inception.

Emerging Markets Value and Small Cap weighting allocated evenly between International Small Cap and International Value prior to January 1989 data inception. Two-Year Global weighting allocated to One-Year prior to January 1985 data inception.

For illustrative purposes only. The balanced strategies are not recommendations for an actual allocation.

Indices are not available for direct investment; their performance does not reflect the expenses associated with the management of an actual portfolio.

Rebalanced monthly. All performance results of the balanced strategies are based on performance of indices with model/back-tested asset allocations; the performance was achieved with the benefit of hindsight; it does not represent actual investment strategies. The model’s performance does not reflect advisory fees or other expenses associated with the management of an actual portfolio. There are limitations inherent in model allocations. In particular, model performance may not reflect the impact that economic and market factors may have had on the advisor’s decision making if the advisor were actually managing client money.

Past performance is no guarantee of future results.

The Dimensional Indices have been retrospectively calculated by Dimensional Fund Advisors LP and did not exist prior to their index inceptions dates. Accordingly, results shown during the periods prior to each Index’s index inception date do not represent actual returns of the Index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Verus Financial Partners), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Verus Financial Partners. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Verus Financial Partners is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Verus Financial Partners’ current written disclosure statement discussing our advisory services and fees is available upon request. If you are a Verus Financial Partners client, please remember to contact Verus Financial Partners, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.